Service Profit Centers at Convention Centers – Electric Services – How to Evaluate Current Business and Improve Revenues and Profit

In today’s convention centers designers have specified electrical capacity and distribution to service any event in the market with respect to electrical demand per square foot. They have truly “built the church Easter Sunday”. The distribution network is uniformly distributed in floor boxes across exhibit halls for 110/208V applications and there is usually a high voltage (460V) bus or connection panel overhead to handle discrete heavy electrical loads or to supplement floor box capacity. In my experience I have only seen a capacity problem a few times and that was just for an exhibit hall, not the full facility. Normally for events, convention centers experience a high diversity factor. Diversity factor is defined as: Total Connected Load/Actual Maximum Load and it demonstrates the degree in which surplus electric capacity was designed and built. The investment in the electrical infrastructure; floor boxes, distribution cabling (embedded in exhibit hall floors), distribution panels, transformers, switchgear, and high voltage feeders (with capacity redundancy) is substantial and rarely fully utilized. The recurring costs of cleaning, maintenance and periodic testing is significant also.

How Are Electric Services Rendered for an Event?

A team of electricians normally begins connecting, labeling and laying out cable for each exhibitor ordered service, directly following exhibit booth mark-out. Cables are coiled and labeled at the back end of each booth or laid out, taped down and positioned in accordance with exhibitor plans. The usual service is one plug-in point and services are sold in that fashion. High voltage service requiring an overhead cable drop is normally supplied at the same time. Other services; connecting exhibitor equipment, installing rented lights, and dressing wires are completed during construction of the exhibit booth. For a well organized team, the fulfillment of advance orders before the event commences move in can be done efficiently, before freight move in is well underway and detailed exhibit building begins. Fulfillment of electrical orders received on site is of course more difficult and time consuming. Labor is by far the largest cost element in rendering electric service, other cost elements, materials, supervision, electrical consumption and administration are relatively minor.

Electric Services as a Convention Center Profit Center

Electric service ranks in the top three or four profit centers for convention centers along with rent, food & beverage sales and internet/telecommunications. It’s a reliable source of revenue and necessary to reduce dependence on subsidies to cover operating expenses. If your center has the opportunity and drive to reach a position of needing no subsidy – where earned revenue will cover expenses and then some, your team will need electric services to achieve that goal.

There are three typical business arrangements:

- Self Operation (also referred to as “in-house”) – The convention center provides this service through their own utilities division. The division is responsible for all aspects of the business; management and floor supervision, administrative of service orders, obtaining a labor force with all the HR functions included (hiring, firing, training, payroll, etc.) , material purchasing and inventory control, planning and implementing event installation, customer service, and probably a great deal more.

- Exclusive Electrical Contractor – Convention centers may choose to have an exclusive contract with an electrical contractor. The choice of contractor is normally the result of a competitive process. The process is characterized by rigorous due diligence which examines all the aspects of operating a service business. Final selection often requires approval of the board of directors. Commission rates range from as low as 12% to as high as 35%. Occupancy and the nature of booked events clearly influence commission value.

- Open (Show Manager’s Choice) – This choice is not as open as the phrase implies. Convention centers normally must approve the contractor and many already have a list. Los Angeles Convention Center for example has three approved contractors. Sometimes the center will issue a “preferred” list of contractors. The review or vetting process for approval usually covers items like a financial review, a safety record review and adherence to required union collective bargaining agreements. Most convention centers require a fee or commission on gross revenue be paid by the contractor to the convention center for use of the facility.

Pricing of Electric Services

Most convention centers and/or their exclusive electrical contractors price their services on a market basis. Convention center management recognizes that cost- plus pricing, while simple and easy to justify, is not an effective pricing strategy. Cost- plus ignores competition. A convention center could decide on service prices based on the cost- plus formula and then be surprised when it finds competitors charging substantially different prices. This can unfavorably impact on the profits a center can expect to achieve or put their market share at risk due to high prices. The center either ends up pricing too low and giving away profits, or pricing too high and experiencing an erosion of revenues.

A typical price schedule sets prices in accordance with different operating voltages and electrical demand (watts) for 110/120 Volt service and in current (Amps) for 208 and 460 Volt service. For the later there is a premium placed on three phase service. The prices of course vary from city to city and it’s evident that consideration is given to the pricing of regional and national competitors. Rental items such as plug-in strips or display lighting are also priced on a market basis. At first glance of an electric service form these prices appear as a flat fee. It’s the application of labor charges to these flat prices which make things confusing and questionable; often a source of resentment from exhibitors. Hourly labor prices (which are wages, benefits, taxes plus a mark-up) are high considering the rudimentary level of skill and training required. Some convention centers, Boston Convention and Exhibition Center, the Javits Center, the Orange County Convention Center, the Austin Convention Center, the Indiana Convention Center include labor in the price of all 110/120V, 208V and 460V service. From a customer service view this is a wise and politic pricing strategy. There is predictability for exhibitors and there is no uncertainty or distrust of labor productivity. The margin risk is all on the convention center.

Which Business Arrangement Fits Your Business Model and Financial Goals?

There is a tipping point where self operation of electric services makes the most business sense. It would require a favorable history of occupancy and electrical revenue per net square foot with reliable forecasts of consistency and growth. As a rough estimate, I believe the tipping point would be an occupancy rate of about 50% where the majority of the events are trade and consumer shows or conventions with exhibits. Otherwise, the sensible course is to retain an exclusive electrical contractor, large enough to sustain business due to work elsewhere. The contractor must be able absorb the overhead required to keep the convention center arm active and to reliably organize a capable work force for events.

Convention centers contemplating a transition from an Open arrangement to an Exclusive Contractor or Self Operation will find a more challenging situation. The Open arrangement typically exists in convention centers which are large with excellent occupancy, and well booked with trade and consumer shows and conventions with exhibit floors. It exists in Las Vegas, San Diego, Los Angeles, Anaheim and San Francisco. It also exists in Miami Beach and Chicago at McCormick Place. The Open arrangement is an attractive bonus for tradeshow managers as most contractors working directly for the show pay show management a commission on revenues received from exhibitors. Convention centers too often demand a user fee from whatever electrical contractor the show manager selects, dividing the contractor’s revenue further.

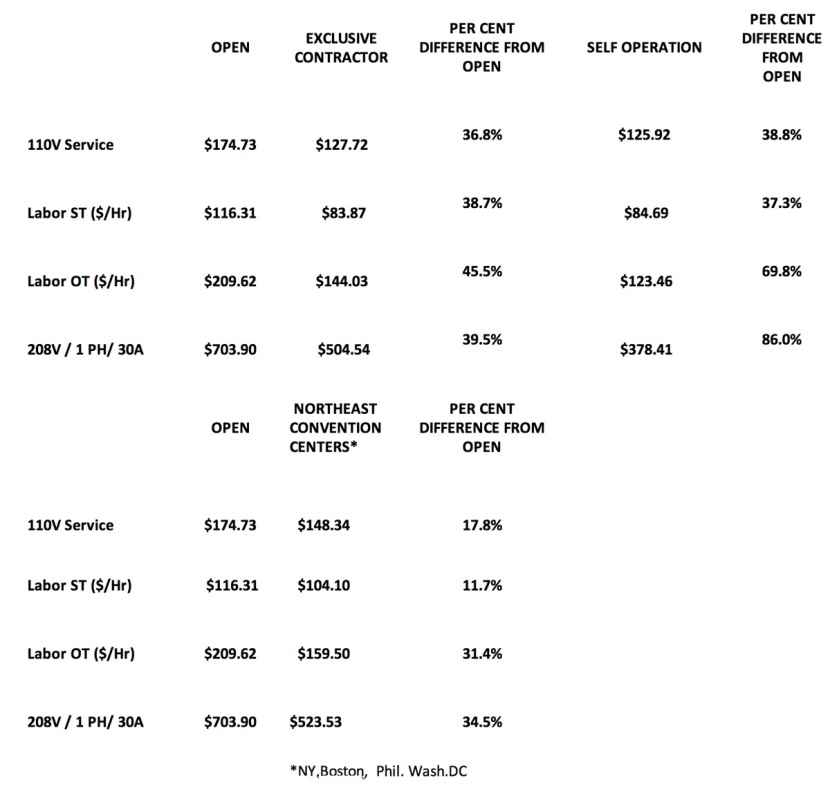

There will be controversy surrounding the decision if a center elects to change certain businesses from Open to Exclusive or Self Operation. There has been one recent controversy that became very public. The example often cited is the dispute between the San Diego Convention Center and United National Maintenance. It involved transitioning from an Open business arrangement for event cleaning services to Self Operation. The dispute carried on for years through the courts and then to an Appeals court before the ruling came supporting the convention center. Negative publicity was aggressive and shrill. Tradeshow advocacy organizations (SISO, ESCA, IAEE) all offered support warning the San Diego Convention Center’s actions would “….. most likely will cause organizers to look for more user-friendly venues “ and “create an open door policy that will allow the center to institute new practices of exclusivity that can reduce service and increase costs to all parties.” The outcome has been that the San Diego Convention Center is still a venue in great demand and has just finished their most successful year. The irony is that none of the assertions about service quality and high prices are true. Convention centers which have an Open arrangement for electric services are by far the highest prices nationwide (see table below). We researched several price schedules for each Open arrangement and it was rare that we found service and labor prices set at a value to help exhibitors (see table below). Additionally, it was evident that certain business practices such as piling on high priced labor to 110/208 or 460V service, charging absurd labor prices for service ordered while on site, insisting that all electrical work, no matter how rudimentary, is the jurisdiction of their electricians, are the norm. A review of current service order forms nationwide showed these practices slowly disappearing from convention centers which are handled by Exclusives or are Self Operation.

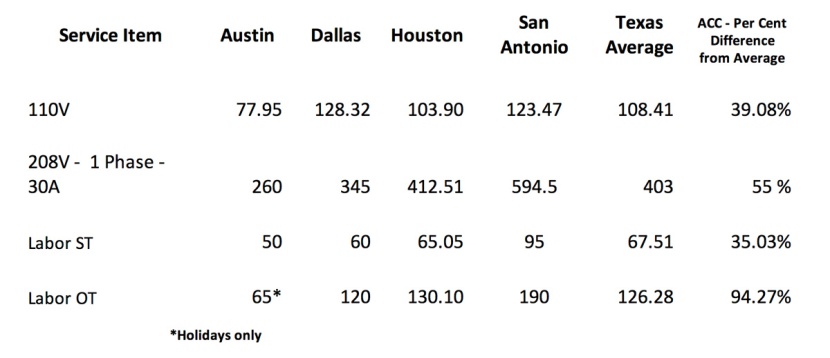

In the table below note that the 110V prices are composite prices based on historical service order proportions at the Javits Center; 500W – 52%, 1000W – 24%, 1500W – 16.5%, 2000W – 7.5%.

Considering the business volume in trade and consumer shows at some of the convention centers the prospect of changing from Open to Self Operation is very attractive. The pricing could be moderated and stabilized somewhat, service prices could become flat rates, the time and material charges could be eliminated, center management would have another fee that could be used during negotiations to attract new business and of course profits in excess of the fees already received are a certainty. The legacy of current pricing and the fact that revenues are not divided up for commission and fees to others make it so. Self operation would give the center better control over staffing, better negotiating leverage over the union work rules and better control over circumstances where there is a series of events with compressed move in time. I acknowledge that this would be a tough decision. Perhaps it is in your best interest to leave things alone, allow the shows another opportunity to profit. I personally have seen shows which were having great success at the Javits Center, take the risk and choose another city and venue where rent concessions were offered that Javits would not match. Above all the advantages New York had, more attendees, more exhibitors, more media attention, profit mattered most. My advice if you are considering such a move is to be impeccably well prepared, prepare your board leadership for the criticism and over-the-top claims from the trade show industry and trade show press, prepare your legal team for some form of legal action, be strong and assertive when the dialogue gets out-of-bounds both in fact and tone and conjure up a little intestinal fortitude.

Ways to Increase Electric Service Revenues and Profit

Understanding, Evaluating and Acting on Your Pricing Power

For those unfamiliar with the term “pricing power”, Investopedia explains it like this,

Pricing power is an economic term referring to the effect that a change in a firm’s product price has on the quantity demanded. Pricing of that product power ties in with the Price Elasticity of Demand. Generally speaking, if a company doesn’t have much pricing power then an increase in their prices would lessen the demand for their products.” In this circumstance, demand elasticity may be seen in certain exhibitors choosing not to exhibit, or a reduction in the size and complexity of exhibit booths, or worse – an event manager re-locating to another city and venue because of high prices.

Comparing Base Pricing – Shown below are two examples (Orange County Convention Center and Austin Convention Center) which were chosen because they were clearly underpriced compared to regional and national competitors. The examples also demonstrate how pricing power can be evaluated.

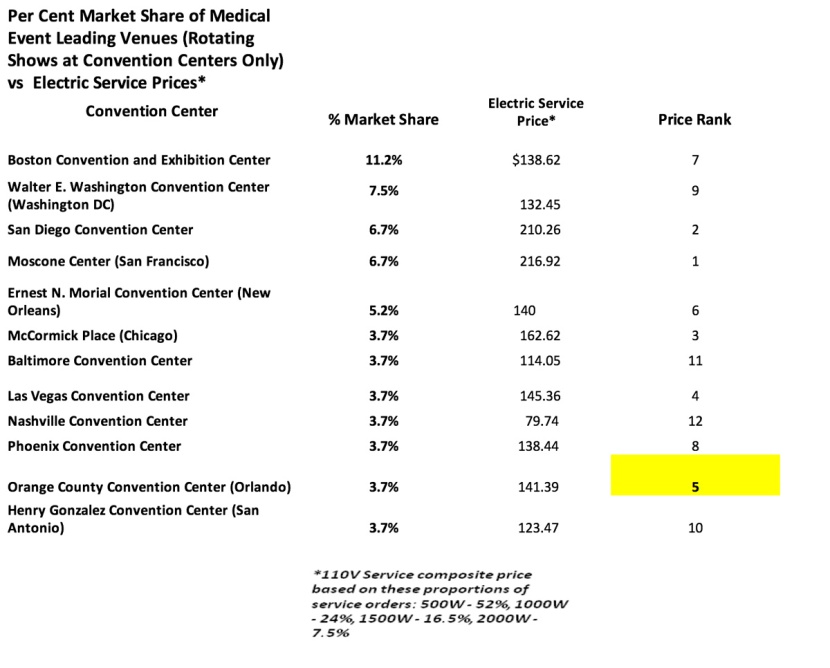

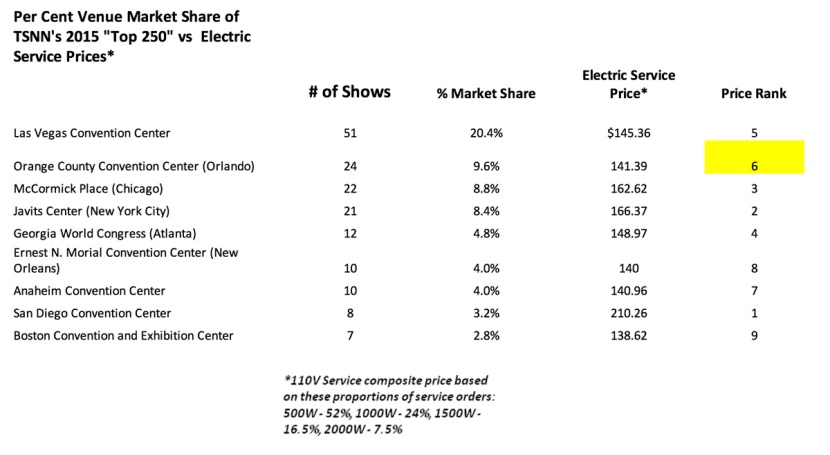

- Orange County Convention Center – The Orange County Convention Center has a 9.6% market share of “Top 250” trade shows and conventions, ranking 2nd in this highly competitive market. The facility is a formidable competitor nationwide for many economic sectors. The analysis below shows how the center ranks with respect to electric service pricing when compared to direct competitors for Top 250 events and major medical events that rotate annually from city to city. It’s important to note that in both examples market share and the price of electric services had no statistical correlation, i.e., high electric prices did not lower market share nor did low electric service prices increase it.

Given the above, what is the pricing power available to the Orange County Convention Center? For Medical events, the center ranks at about the median and below the average of $145.19 by 2.7%. For Top 250 events the center ranks below the average of $155.30 by 10%. A comparison of single phase 208V service prices shows an even greater split between Orange County and the other market share leaders of over 75%. While the proportion of high voltage service for trade shows is low compared to 110V, the span of difference only adds to the pricing power that Orange County possesses.

From Orange County’s annual reports it was learned that revenues derived from electric services are about $11 million annually. The price adjustment of 10% would yield an additional $1.1million and would not pose a business risk. It would have to be rolled out gradually and with some forethought and finesse. For example, would the price increase affect the convention center brand element of affordable pricing? Based on the analysis above, I do not think it would.

- Austin Convention Center – The Austin Convention Center is enjoying a lift in reputation driven by such popular events as South by Southwest (SXSW) which has become a national music and cultural event. It is also a venue in demand for IT sector events and annual meetings for state professional associations. The state association business is a sector that it must compete for against other Texas cities and venues. The analysis below compares electric service prices to other state venues.

The Austin Convention Center is nearly 40% less than the average price for 110V services (the most ordered services). From the City of Austin’s annual reports it was learned that revenues derived from electric services are about $2.5 million annually. The price adjustment of 10% would yield an additional $250,000 and would not pose a business risk; 20% would yield $500,000.

Both Orange County and Austin are good examples of how a relatively simple analysis can expose some revenue opportunities which don’t require investment and on the surface pose little business risk. Cautious convention center management may need better assurances of how an underpriced revenue situation could be solved using pricing power while not adversely affecting the normal exhibitor service requirements or their intentions to increase service. In this instance I would recommend a survey of exhibitor attitudes be done independently.

Another Method to Use Pricing Power – Make All Exclusive and Self Operation Electric Service Order Forms Access Controlled – There are other methods related to the service pricing and the presentation of the pricing schedule which can be used, especially with a self operation arrangement, to increase revenue. These methods are practiced mostly by the electrical contractors who work in the Open arrangement previously described. There appears to be a real “tradecraft” in their practice. There are many reasons related to security for making all on-line service orders access controlled. Access control also all permits convention centers to make price changes based on the type of event or prior history of the event; certain industry sectors are less price sensitive than others, prior event history may show that certain service or rental items are ordered more than others, certain type of events may have more late or floor orders than others, etc. In all cases the pricing adjustments should go up, not down and most importantly – don’t overreach.

Increasing Profit through Productivity Gains

Structural Changes to Electric Service Work Jurisdiction – There is a silent conflict that exists between two trade groups and their work jurisdictions which impedes the ability to increase productivity and profit for electric services. The conflict is between electricians and carpenters or stage hands (who assemble exhibit booths). In most exhibits there is some placement, dressing or connection of electric cables to devices which are integral to exhibits or attached such as a video screen or exhibitor owned display lighting. The connections referred to are simply devices using a straight stab plug to a power source supplied or an extension cord. Electricians generally win the argument. That means that electricians normally have to re-visit the exhibit booth sometime after the base power is supplied. At this point the aisles are crowded with freight, other tradesmen and exhibitors. It’s time consuming, so the time to fulfill an electric order is increased and productivity declines

Two convention centers have recognized this and wisely changed these rules, the Boston Convention and Exhibition Center and the Orange County Convention Center. In both cases the service order forms state that electricians are not required to be used for electric distribution within the exhibit booth; General Service Contractors or EACs (carpenters) or exhibitors may do that work themselves.

The Javits Center Experience in Boosting Productivity – 1997 to 2008 – By the end of 2000 Javits management reckoned that their electric service pricing power had run out; that increasing service prices may result in a decline in service order growth, exhibitor complaints and possibly recurring shows looking for other venues. Our national competitors had begun to moderate their prices but more disquieting was that some competitors had started to offer heavily discounted rent or no rent in order to gain market share. We had been casually tracking key performance indicators (KPIs) such as labor hours per billable item, electric revenues per net square foot per show and per exhibit hall and order fulfillment percentage per move in day. Now the KPIs had become much more meaningful and we acted on what the KPIs showed. We set productivity goals, labor hours per billable item and electric revenue per net square foot per exhibit hall worked best. We held labor supervision accountable for improvements in labor productivity and surprisingly did not have to make many personnel changes. Productivity climbed. Profit margins climbed concurrently to about 30%. Once the work habits and routines and the necessary levels of productivity were understood and accepted, price increases became modest, keeping us competitive. Labor rates did not have to be applied to service rates because we had confidence in including labor costs in flat rates.

Adding New Products and Services

Here are a few examples of things that have worked:

- Sale of extension cords of differing lengths

- Sale of spare light bulbs. Carry a ready inventory of common retail display lighting

- Rental of high wattage light fixtures with a high color rendition index (above 80). If your center hosts fashion, textile, gift, automobile or art shows, then an investment in this type of lighting may be a worthwhile expenditure. The lighting is normally suspended from overhead lighting truss or catwalks. The price point for rental units is high ($ 325 at the Sands in Las Vegas and $341 at the Javits Center). Sales volume is also very high. At Javits this lighting comprised 8% of total annual electric revenue.

Recommendations

- Is your current business arrangement in your center’s best interests? Consider self operation of electric services. It may be the best method to increase revenues

- Do a cursory comparison of base pricing, labor pricing and time and material pricing of your regional and national competition .Make judgments about your pricing power. If you find opportunities drill down further

- If results are favorable, create a new pricing schedule and simulate a new year using previous years business volume and service order proportions. Review forecasted revenue results.

- Share results with board members. Persuade them to buy in to a change

- Review all your internal procedures; planning, labor assignments, KPI tracking, material control, etc. for the purpose of increasing productivity. Plan on changes and forecast results.

- Revisit pricing schedule and simulation and factor in predicted productivity gains. Review forecasted profit results.

- Make a decision to launch new electric service pricing

- Invest in software to create on line access control for electric forms for each show

- Launch new pricing. Do so gradually and let show managers know. Don’t overreach.

For convention centers interested in improving service revenue and profit, consider the services that MTMConsult, LLC can provide. Our team of experienced practitioners with real field experience will drill down to the important details and provide actionable results.

Email us at advisor@conventioncenternow.com or call – 203-273-6999

The Math and Logic behind Sales Forecasts in Convention Center Expansion Feasibility Studies

In my time at the Javits Center, I was personally involved in three expansion feasibility studies with two different consulting firms. My intention in this piece to explore the sales and marketing forecasts which are considered and are integral to economic impact estimates and ultimately convention center financing and construction.

The acquisition of investment financing, especially at the scale of a convention center expansion, requires a feasibility study prior to launching the project. Traditionally expansion feasibility studies consist of several phases that fall under these categories:

- A review of history of event activity (# of shows by type, by season or month)

- A review of history of occupancy (the whole convention center, by month, by space – exhibit halls, meeting rooms and ballrooms)

- A review of history of attendance (for all events, by event type, by season or month, with out of town attendees broken out)

- Competitive analysis of the same performance statistics above

- Competitive analysis of the size for the whole facility and by exhibit space (incl. # and size of subdivisions), meeting rooms (sizes and #) and ballrooms

- Destination comparisons and rankings for competitive cities such as reputation as an event city (all and certain sectors) and other city attributes such as hotel inventory and brand mix and distance from the center, airport service and passengers per year, etc.

- Forecast of new events if certain actions/investments are taken. Presumably facility re-fit and renovation and/or expansion.

- Estimate project costs

- Estimate new income

- Estimate ROI

- Estimate incremental quantitative economic value/benefits ( event attendee spending, direct and indirect employment) and qualitative benefits

There are some impediments and challenges to accomplishing the above:

- Firstly, few convention centers keep disciplined records of performance indicators that neatly fit a feasibility analysis (occupancies, net square footages, event attendees, profit/loss per event and per event type or profit/loss per net square foot). Occupancy especially is troublesome because some convention centers measure differently from the prescribed method.

- Secondly, many industries are well covered by academic research and scholarly articles citing statistics and making thoughtful rational explanations. For the convention and trade show industry there are few, especially in regards to convention center expansion. Occasionally there is an insightful article in newspapers or business magazines, but not the scientific or rigorous statistical analysis you might expect to see.

- Thirdly, attendee numbers are mostly self reported by the event managers, very few are audited results. Most experienced convention center management teams regard them as probably exaggerated and unreliable. Conversely hotel room nights are reliably reported and most CVBs track these statistics. However, these statistics are many times under reported. For mature shows that consistently have returning attendees each year, there is anecdotal evidence that many book their own hotel accommodations and are not reported in the “room block” (where the hotel room night statistic is derived).

- Lastly, many feasibility studies were strongly influenced by the intensity and drive of local hospitality businesses, all with the enthusiastic support of political leadership. For consultants it is and was difficult to stay objective. That seems to be changing over the last few years.

Where Things Stand Now

Trade and Consumer Shows and Conventions with Exhibits

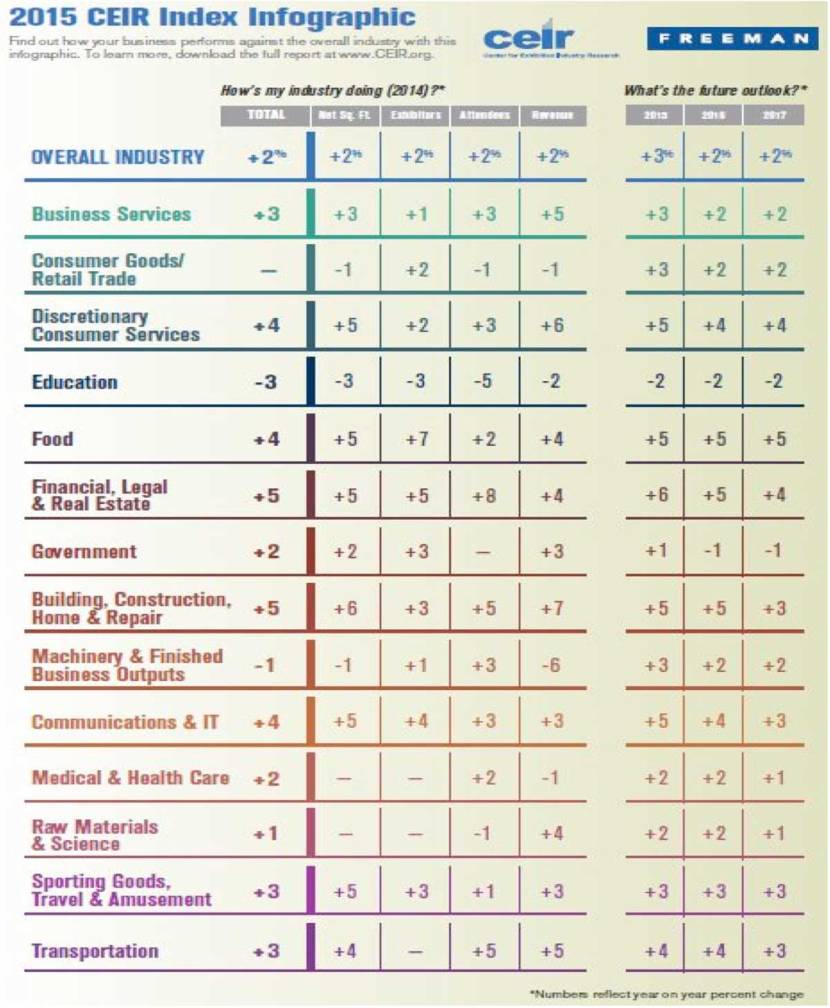

Tradeshow and convention directories list over 5,000 trade and consumer shows and association meetings or annual conventions. Generally not listed are private corporate events like annual sales meetings, IT developer conferences, or product roll outs and demonstrations. The very information rich table shown below is taken from CEIR’s forecast of industry growth from 2014 through 2017. You can download it at https://www.ceir.org/sites/default/files/CEIR%202015%20Index_Infographic_0.pdf. As shown, the growth rate is 3%, which puts the industry back at pre-recession levels. The only industries in decline are education and government services. Note that the statistics measured which make up the CEIR Index are net square feet, attendees and # of exhibitors, some of the same statistics which are important when judging convention center performance.

Convention Centers

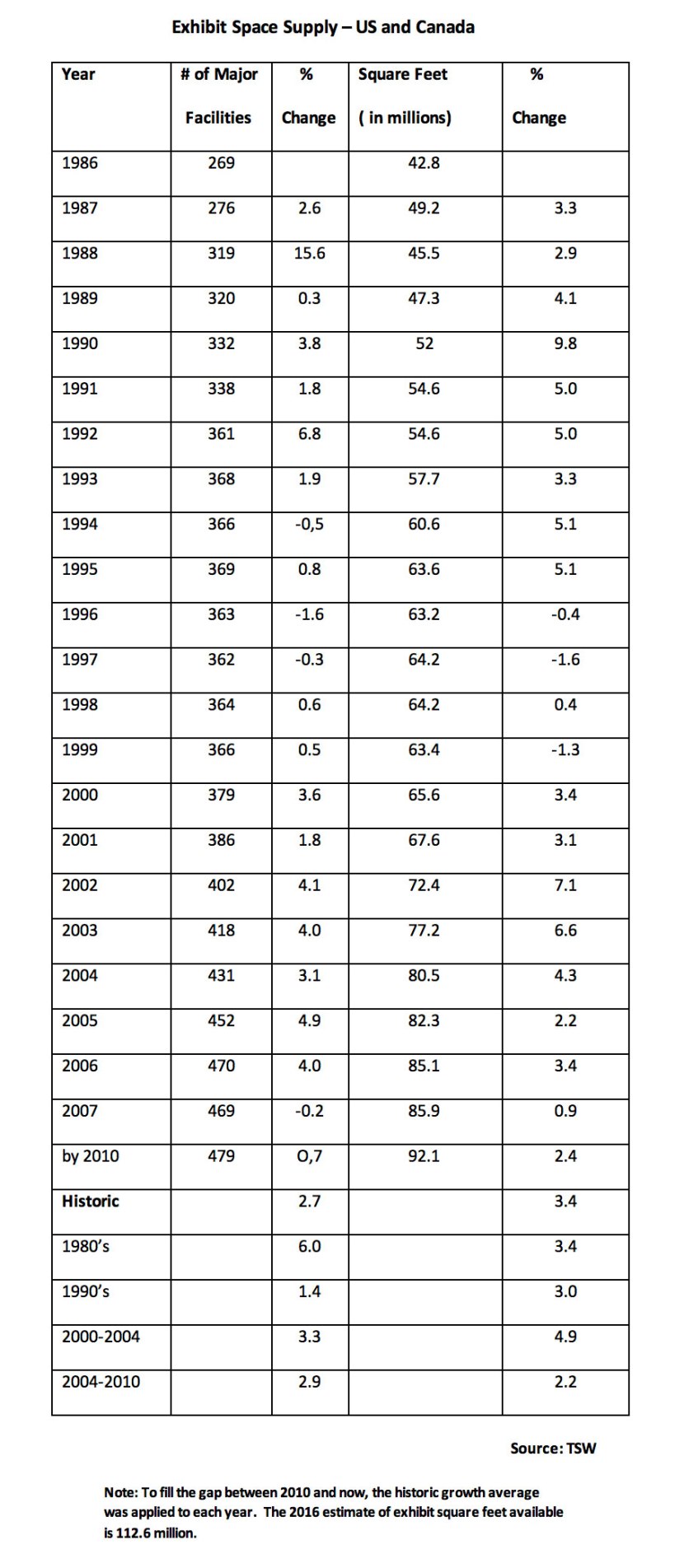

For convention centers there is no CEIR to act as a clearinghouse of data collection and analysis… The industry used to rely on Tradeshow Week (TSW) to periodically publish information in directory style about the amount of exhibit space available nationwide and then apply a percentage growth and make a forecast for the next year. TSW ceased publication in 2007 and the easy to follow directory was not available. It is instructive to look at the rate of growth through the years that TSW was published:

There is no way to statistically tie the scale of total exhibit space and the rate of growth to the scale of shows (expressed in net square footage) and their rate of growth without an extensive research project. Other consultants have tried to make adaptations to the facts they could find supplemented with many assumptions. Their attempts to show the relationship and bring clarity to the subject were noble efforts but they just won’t fit into a feasibility document reviewed by bankers, political leaders and of course the public. If you’re not convinced there’s an oversupply problem which has a material effect on your center’s performance, consider these facts:

- The event industry is growing and only a small fraction of convention centers can consistently boast above 50% occupancy, so there’s lots of vacant space.

- Falling prices is a marker for oversupply. Oversupply is not uncommon. It extends beyond commodities like wheat, corn or oil. It extends to finished goods like LED lighting where prices have fallen 40%. It extends to convention centers too. Convention centers are still deeply discounting or dropping rent charges to keep market share. You might expect that revenues at convention centers would rise in concert to the revenue increases seen and forecasted in shows. They have not. Most are declining.

How Did This Happen? Why Is There Such a Surplus of Convention Center Space?

Most of us felt there was an oversupply problem 10 years ago. Still from 2005 t0 2015 exhibit space increased over 30%. A vocal critic of new and expanded convention centers emerged in the 1990’s, Professor Heywood Sanders (University of Texas-San Antonio). He focused his attention on the obvious – most of the forecasts from feasibility studies did not happen as predicted. In fact they were highly inaccurate. He also focused on the methods in which public officials managed to finance convention center projects. His conclusion was that the events such as the 9/11 attack, while material, would not have stopped the poor performance of expanded convention centers even if the attack had not occurred. His premise was that the studies relied on survey data of expectations (opinions of prospective show managers who were interviewed) and not on actual data. Professional statisticians would agree. They would recognize this common tendency to ignore prior history when making important decisions. Statisticians have given this tendency a name, base rate neglect. Base rate neglect can occur in any field; engineering, science and business. In business, case studies find most managers depend more on new and highly relevant information, favoring it over the base rate Sanders characterized the studies as “faulty analysis, erroneous conclusions”. Professor Sanders had and still has powerful disciples. Business writers from well known publications weighed in. Business writer Victoria Murphy wrote an article in the Forbes February 2005 issue “The Answer Is Always Yes”. In it she took aim at the Oregon Convention Center:

Today, $116 million in bricks, mortar and carpeting later, Portland’s trade hall is struggling. It lost $5.5 million last year on $15.3 million in revenue. Occupancy since the expansion has fallen from 71% to 43%. The Wood Technology Showcase, a Portland event for 34 years and one that expansion boosters cited as needing the enlarged venue, has been postponed because of lagging attendance. The same run-down buildings and third-rate restaurants that always surrounded the center, like Burgerville and a deli that sells sushi and Beanie Babies, are still there.

“We haven’t set our sights on being profitable,” says Oregon Convention Center’s executive director, Jeffrey Blosser. “These are challenging times in our industry.”

Challenging? The business is a mess, plagued by a taxpayer-funded burst of expansion and a continuing dearth of customers. Over the last decade cities’ annual capital spending on centers has doubled to $2.4 billion, according to a study by the Brookings Institution. The projects are frequently backed by expensive feasibility studies from consultants that rarely give a thumbs-down. Forty-four new or expanded halls are in the works, in hot spots such as Las Vegas and not-so-hot spots like Albany, N.Y. Seven million square feet will be built in the next few years, adding to the 64 million square feet now standing.

Unmentioned at ribbon-cutting ceremonies is that the space will be impossible to fill. The biggest 200 shows, a rolling list measured by Tradeshow Week, are using the same amount of space they did in 1992. Attendance has fallen at most centers, even those with new space such as in Indianapolis, Chicago and Atlanta. The thriving destinations, Orlando, Fla. and Las Vegas (which just announced a $400 million expansion), are stealing smaller shows away from other cities, stuffing in several at a time. The smaller trade halls are discounting, even giving space away.

….. By the end of 2004 the center’s finances were in bad shape. To get 34 decent-size shows, the center had to indirectly waive rental fees for the organizers of 10 of them. The building would have lost $15,000 a day if not for $6 million in tax subsidies. Hotels are 60% occupied, as fewer than 30% of convention-goers last year came from outside Portland.

The fix, says center director Blosser, is a new 600-room convention hotel, backed by the city. “We lose a lot of shows because we don’t have a big hotel. But it doesn’t pencil out for a private company; a hotel here would need help,” he says. Blosser commissioned Strategic Advisory Group, an Atlanta consultancy that specializes in convention center and hotel studies, to assess the idea. SAG says the new hotel will bring in annual spending of $116,000 per room.

Maybe Blosser should run those numbers past the folks in St. Louis. In 2003 St. Louis followed a $270 million convention expansion with a 1,081-room, $265 million adjacent hotel, paid for with public and private money. Hospitality Consulting Services projected 800,000 room-nights per year citywide with the addition of the Renaissance hotel. Instead St. Louis is getting only 400,000. A nearby McDonald’s closed shop. The neighborhood remains lackluster, punctuated by a store peddling gold chains and a discount sneaker outlet.

In August Moody’s downgraded the city’s $50 million hotel bonds even deeper into junk. The development group will likely have to drain the $5.7 million left in its reserve fund to service the debt and come up with additional money from stakeholders like Kimberly-Clark. “The assumptions that go into feasibility studies are the problem,” says Anne Van Praagh of Moody’s. “The outside firms have no financial stake in the business.”

There simply was not enough accurate data to clarify and validate demand and what data there was too often interpreted poorly. Professor Sanders believes that the consultants should have known better and expanded their scope to include more historical research. He strongly implies that a group of consultants played the game fast and loose. However as I have experienced, what little they presented was enough for the clients. Clients were more inclined to accept positive interpretations of data and research and readily used it as validation to pursue financing and expanding. There were also many other strategic judgments which had to be made beyond the feasibility studies; competing for tourists and business tourists among cities, creating a means to better distribute the tourism dollar to include seasons which are not traditionally vacation time, bolstering the tourism physical infrastructure, creating steady service industry jobs to working class and immigrant citizens, etc. Enlightened city leadership sees the role of government to invest in those things that are going to support an economic and social strategy for the future. Building the kind of facility that will enable a city to attract and accommodate the kinds of business, academic, professional and investment-related activities that support such a strategy is more of an obligation than an indulgence.

Other Observations, Inferences and Theories

Yes, in hindsight there were some poor decisions made in the 1990’s and early 2000’s regarding expansion. We know that now. However, some extraordinary world and national events took place during this time which seriously impacted the performance of new and expanded convention centers:

- The internet/IT boom and bust cycle – Certainly everyone took notice when COMDEX was sold in 1995 for $800 million. Many, including convention centers in Las Vegas, New York, San Francisco and other cities profited also. The boom cycle lased for about 5 years. New concepts in technology meant new shows. Large horizontal IT events would spawn vertical shows which would often play at smaller venues. When the market bubble burst in 1999/2000 it was a shock to all venues that had relied on technology trade shows. Some consultants advised their convention center clients that the downturn would be short-lived based on the recent short recession in the early 1990’s. Things didn’t turn out that way. Then:

- The 9/11 attack – A general malaise settled over the industry, business travel slowed to a crawl, attendance dropped, shows cancelled and other marketing channels were emerged

- Structural changes in marketing communications – Certainly the rise of on-line advertising, shopping and buying had an affect on trade shows and conventions.

- The on- set of the Great Recession 2008 – The pace, the acceleration of business and banking failures, and the loss of market value hit worldwide. Of course this would affect the convention and tradeshow industry profoundly.

- The expansions that took place in the last 10-15 years were either under construction or were in some way committed to proceed. They faced enormous impediments given the events listed above.

Critics and doomsayers of convention center expansions apparently believe that growth industries should be buttoned up and tidy. They are not; they are disorderly and at times chaotic. They have conservatives influences and risk takers. In a highly competitive industry risk takers usually come out on top. Critics should stop and take a top down long view of the convention center business and consider the normal risk factors and business cycles that can and do occur in nearly all growing business sectors. . The consulting firm HVS, explained it best:

As an established industry, continued growth in demand will come not from latent sources, as occurred during the last few decades. Rather, industry growth will depend on new demand, which is affected by numerous factors such as the cost of travel, the importance of face-to-face interaction in certain industries, improvements in facility design, resources available to promote events, trend in how firms allocate their marketing budgets, and overall growth trends in the national economy. In most industries that go through periods of overbuilding (e.g. hotels, residential, shopping malls, and office space), the ability to generate private return on investment eventually limits the expansion of supply. Since most convention facilities are publicly financed, this market discipline is not necessarily present. Instead limited resources of governments and the public decision making processes that consider the merits of capital investment place limits on supply growth. In our experience, most municipalities are not “willing to try almost any investment in their quest for more convention visitors.” Concern over the proper allocation of limited resources and historical experiences of success and failure play very important roles in the decision making process. Which brings us to a point of agreement with Sanders’ overall conclusions: careful and realistic consideration of the chances of success should inform the public decision making process about investment in convention centers” Concern over the proper allocation of limited resources and historical experiences of success and failure play very important roles in the decision making process.

Expansion project costs are normally quite high but sometimes a good fraction of the financing is not related to expansion of sellable space. Rather, the financing is used to pay for deferred maintenance. Deferred maintenance can be extensive preventive maintenance, corrective maintenance, system upgrades, or repairs that are deferred to a future budget cycle or postponed until funding becomes available. Civic pride, competition among cities for event market share, the city planning practice of creating an anchor or destination spot within cities have caused the construction of massive structures with expensive architectural features and finishes. Many of these building elements and systems are expensive to replace, repair and renovate. They are generally of high quality and durable, reducing the risk of failure. They become easy to defer, repairs are expensive and they can wait. An extreme example is the Javits Center’s recent $453million expansion only saw a very modest increase in exhibit space and virtually none in meeting rooms. Rather, 70% of the funds were used for completing deferred maintenance projects for the roof ( which had legendary leaks since the center was built), the curtain wall and roof glass which had gone beyond its useful life and the HVAC mechanical plant ( 8,000 tons of air conditioning capacity supplied by roof top package units). I believe other convention centers face similar problems. Deferred maintenance costs build and compound year to year, while municipal or public authority budgets typically drop these line items year after year. They don’t go away and eventually expose themselves with building problems which can affect business. How big can they get? As an example, there is a benchmark for US universities on deferred maintenance – about $3.50 per square foot. Apply that to the square footage of your convention center. Convention centers should know before they build how deferred maintenance costs will affect them in the future. Designers should do a life cycle costing of major systems before construction. Often the most reasonable solution is to attach the deferred items in a bond issue to finance expansion.

Recommendations

Our industry is beginning to sober up regarding expansion feasibility studies. From the few I’ve read which were written since 2013, I’ve been most impressed with The Strategic Advisory Group’s Colorado Convention Center Feasibility Study (released in 2014). The presentation is crisp with plausible explanations. The study adheres to the principle of measurement validity, i.e., how well the results of a study measure what they are intended to measure. The measures are relevant and are not lost in statistics which are only material if the study was on a national scale, not just Denver. While surveys of existing and prospective clients were done, the report defers to statistics, principally occupancy and occupancy’s sub-sets. There’s a certain elegance to that. It speaks unvarnished truth and it is all encompassing; all other performance measurements are derived from occupancy. Further it discusses vertical industries and their events which might have a connection to Denver and the Rocky Mountain region. The report examines “city –wides” and effectively explains them in occupancy terms. Lastly it takes the time to discuss the cities brand and tourism attributes and compares them to competitors. The convention center’s venue characteristics are important but the foundation of a favorable brand, a place that people emotionally connect with comes first. For convention centers about to launch a feasibility study read this one first.

If I were a convention center manager about to contract with a consulting firm for an expansion feasibility study, here’s the scope of services I’d ask for when composing the sales and marketing section:

- A narrative including tables and graphs of convention centers’ current position with respect to size and growth and the event industry’s size and growth. If information can be obtained about the #, size and growth of corporate events include that also.

- Obtain the following statistics:

- A history of my center’s occupancy for at least ten years.

- Breakdown the occupancy by month, exhibit hall, meeting room suite and ballroom, and by type event (tradeshow, consumer show, entertainment, banquet, social gathering, corporate meeting, product roll out, film and photo shoots, etc), by industry sector (medical, financial, consumer goods…..)

- A history of the net to gross square footage percentage for exhibit halls

- A history of occupancy for regional and national competitors

- A history of event attendance (note attendance figures that are audited) by type event and by industry sector)

- A comparison of physical plant characteristics with competitors ( size and number of exhibit halls, meeting rooms, ballrooms) , age, configuration (facility map)

- A history of annual revenue and expenses broken down

- A history of revenue earned per square foot (electric/plumbing, telecommunications, cleaning, F&B, etc.) earned annually and by event type and industrial sector

- A history of competitors’ annual revenue and expenses broken down

- A description of hotel inventory – #, rooms, committable rooms, brand mix, distance from center

- A description of restaurants, nightclubs, concert venues in and around the hotels and convention center

- A description of the airport ( # of direct flights to certain cities, annual passengers, etc.)

- A comparison of city brand and reputation with competitors from an economic or social research organization such as Bloomberg Business, the Miliken Institute, The Reputation Institute, and others. Develop a composite rating

- Describe the verticals that occupy the center and include verticals that have events at other city venues. Characterize whether the verticals are or are not a reliable prospect.

- Closely examine the Lost Business reports for the past 5 years. If you consider them unreliable then insist that they be re-visited. Differentiate between turn-aways because of lack of space and /or time of year or days of week and lack of certain services, from service quality, from pricing issues and from destination issues ( such as the quality of hotels, the city crime rate, the city’s overall reputation, etc.

- Develop a list of new prospects and assign priorities based on probabilities of a booking. Do not simply make generalizations about the size and growth of the market and through a judgment call contrive a number of new events

- Construct an Occupancy Model for 3 years forward. Put it in a calendar form and footnote each event with a probability.

I would consider the above phase 1. of the study. There is no need to go further with an economic impact evaluation if the above is unfavorable.

Perhaps you just received a feasibility study for a sizable expansion. Need a second opinion from a team that’s been there and done that? We can conduct a peer review of your feasibility study and point out strengths and weaknesses. These decisions are matters of trust. Consider MTMConsult, LLC .

Email us at advisor@conventioncenternow.com or call – 203-273-6999